Dec 9, 2025

Owning Your Learning Platform vs SaaS: Why Control Matters as You Scale

Words by

Kaine Shutler

Key takeaways

High-growth training companies outgrow SaaS because vendor roadmaps, pricing, and data limits restrict their ability to scale, innovate, and respond to new commercial opportunities.

Owning the platform gives the business predictable costs, clean data, and the ability to adapt without waiting for a vendor or absorbing price increases like the average 11.4 percent SaaS rise in 2025.

Control improves both day-to-day operations and long-term optionality by giving the company a platform it can evolve, integrate, and position as an asset rather than a dependency.

When a training company scales, control of your technology becomes an essential strategic requirement. The LMS often sits at the centre of how revenue is created, how customers experience the product, and how the business adapts to change. If you don’t control that system, you don’t fully control the business.

Control isn’t about building everything yourself. It’s about owning the parts of your infrastructure that dictate your future. For most established training providers, the LMS is one of those parts.

The Hidden Cost of Not Being in Control

SaaS (software as a service) learning platforms are attractive early on. They lower the barrier to launch and removes operational overhead. But the trade-off becomes clearer as the business matures. You’re renting a system that shapes your workflows, data practices, pricing exposure, and product roadmap whether you agree with those constraints or not.

Several patterns tend to emerge:

Roadmaps drift away from your needs

Vendors build for their median customer, not for the nuances of your model. When your learner journey needs something specific, you’re often stuck waiting or compromising.

That creates friction internally: sales teams work around missing functionality, operations patch gaps manually, and product teams lower the bar for what “good enough” looks like. Over time, the platform shapes the business instead of the other way around, and the opportunities you can pursue become limited by choices the vendor makes for their broader customer base.

Pricing becomes unpredictable

Per-user models introduce volatility.

At $5 per user per month, 500 learners cost around $30,000 per year. Add a ten-thousand-learner enterprise deal and that figure jumps to $600,000.

Yes, this is expensive. But the bigger issue is that it makes the cost base unpredictable because your largest wins trigger your largest bills.

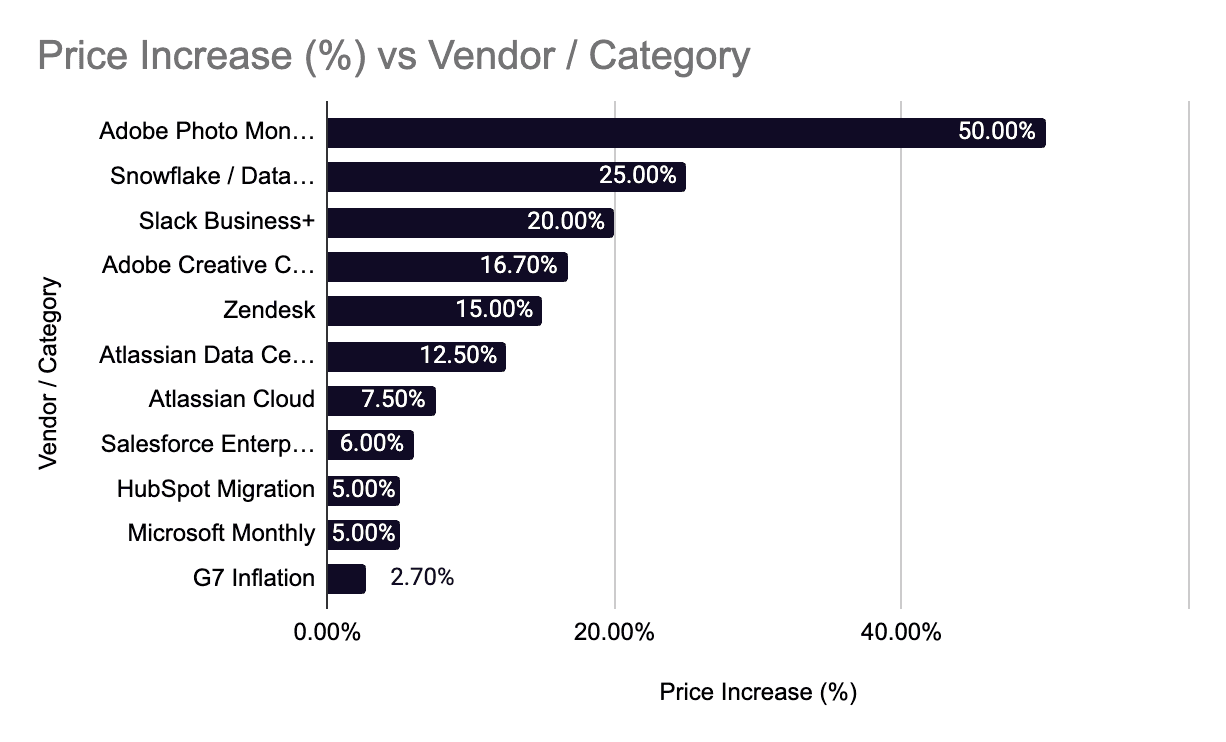

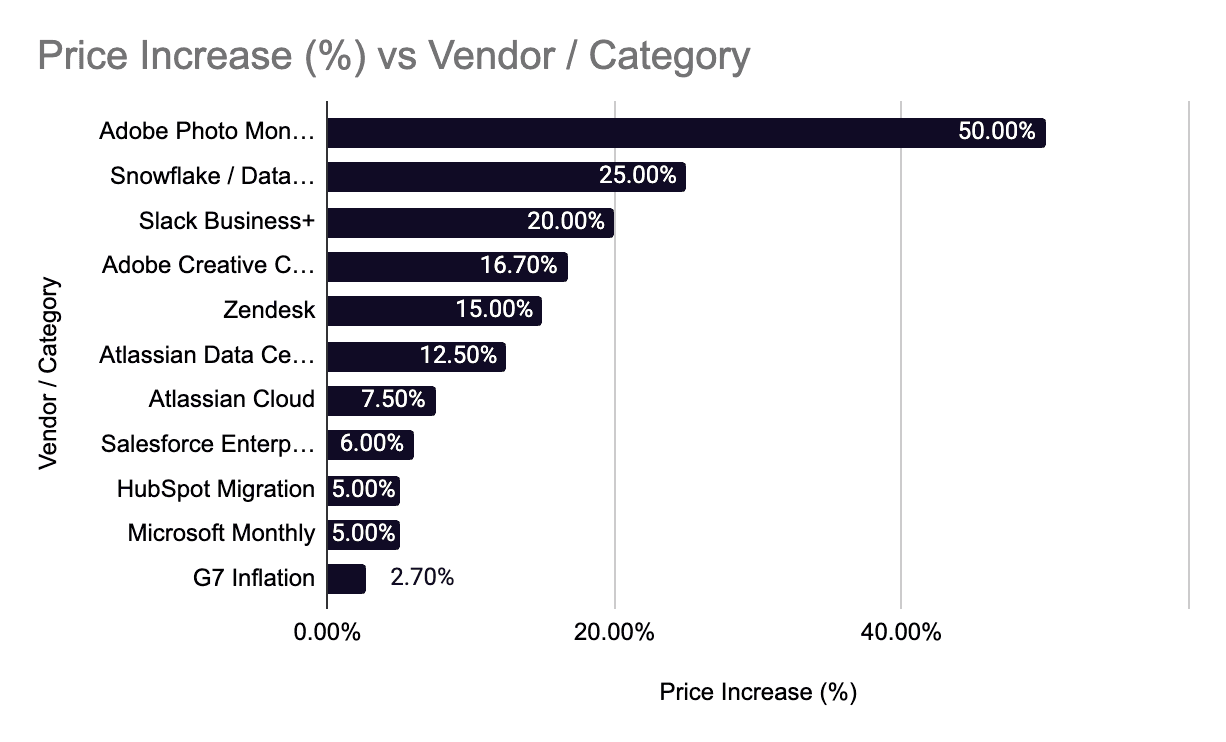

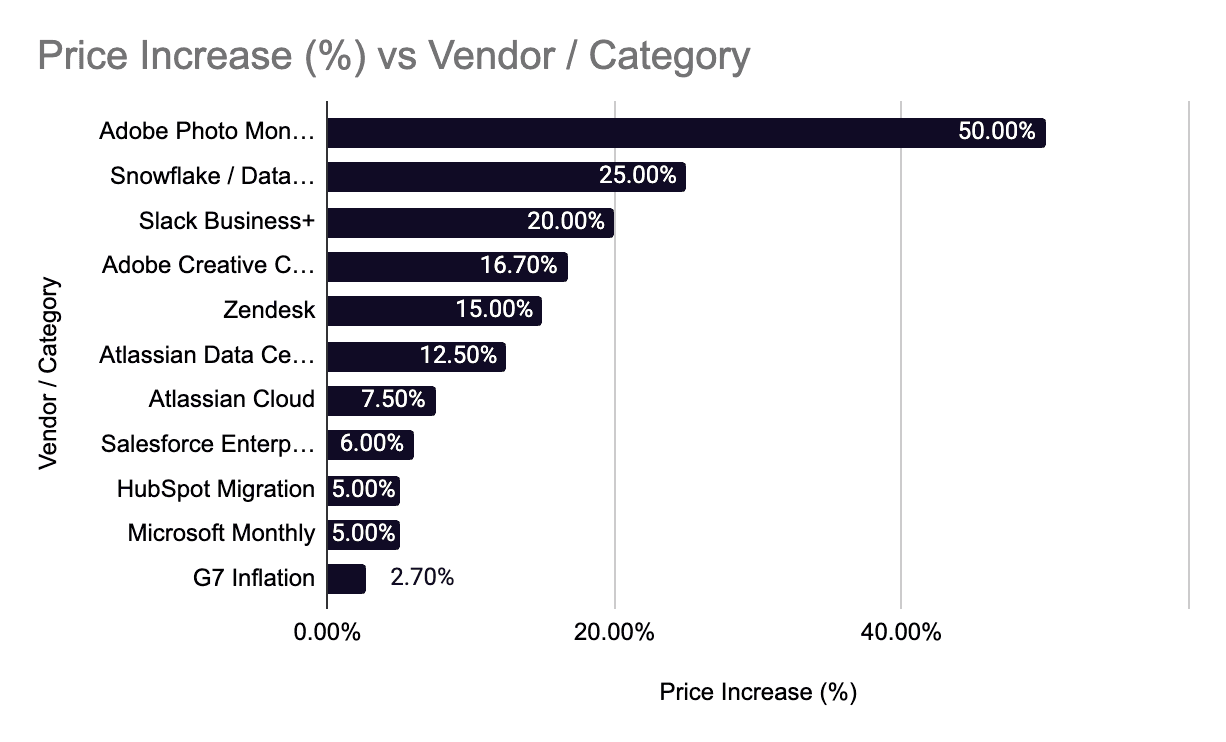

And that volatility has widened in 2025. SaaS pricing rose by an average of 11.4 percent across the industry, with some vendors increasing fees by more than 300 percent after acquisitions. This is not simply because the recent SaaS investments into AI need to be recouped; the average SaaS price increases 8-12% annually (source), which far outpaces average market inflation rates.

Data sourced from saastr.com

So even if your learner numbers stay the same, your costs will not. Forecasting becomes harder, margins narrow unexpectedly, and long-term contracts become more difficult to price with confidence. Over time, the business becomes cautious about pursuing certain deals because the platform itself behaves like a tax on growth.

Data becomes something you use only in the ways the vendor allows

Most SaaS platforms only let you export basic reports, not the structure that links learners to courses, attempts, and historical context. Without those connections, the data stops being reliable. Simple questions become hard to answer: who struggled and why, where people drop off, which content actually drives outcomes, or which clients need attention. Analytics lose depth, reporting becomes less trustworthy, and teams end up relying on assumptions instead of evidence.

These gaps also make it difficult to automate or personalise the experience because the rules that depend on connected data aren’t available. And when you eventually try to migrate or prepare for due diligence, you’re left with spreadsheets that don’t talk to each other.

Rebuilding the relationships is possible, but the bigger issue is the uncertainty it introduces. You lose visibility into how the business operates, and your ability to adapt is shaped by a platform you don’t control.

Workflows bend to the platform rather than the business

Teams learn the product’s limitations and start adjusting processes to fit. Over time, this erodes operational clarity and slows innovation. What begins as a small workaround becomes the new “normal.” Teams structure onboarding, reporting, and even client delivery around what the platform can or can’t do, rather than what makes sense for the business. These compromises accumulate. They make it harder to introduce new offerings, harder to refine the learner experience, and harder to respond when a major client asks for something slightly different. Eventually the platform stops being a tool that supports the model and becomes the reason certain ideas can’t move forward.

Individually these issues feel manageable. The problem is how they compound. Together they restrict your ability to move decisively.

Control Gives You Strategic Options

Owning your LMS infrastructure doesn’t mean reinventing the wheel. It means you govern the parts that shape your commercial model and customer experience.

With ownership, several shifts happen:

You decide the direction, not a vendor roadmap

When you own the platform, changes follow your priorities rather than someone else’s release cycle.

That matters in markets where your differentiation depends on the learning experience, reporting logic, or how you package and sell content.

You don’t have to wait for a vendor to serve the median customer. If your sales team needs a new enrolment flow or your clients want more granular reporting, you can build it when the business needs it. Control removes the delay that slows or kills momentum.

Your cost base stays predictable

Ownership stabilises costs. Hosting and maintenance scale gradually with usage, but they don’t jump when you add new clients. Moving from one thousand to ten thousand learners increases server load, not licensing fees. You’re no longer exposed to per-user pricing, annual price hikes, or the industry-wide surges seen in 2025.

With a stable cost base, margins are easier to model, long-term contracts become simpler to price, and financial planning isn’t influenced by decisions made outside the company.

Data becomes something you can rely on

When you control the schema, you know how events are captured and stored. You can answer deeper questions about behaviour, segment learners in ways that match your commercial model, and build analytics that support sales, retention, and product decisions.

And if you ever need to move the platform, you take the full data structure with you. You aren’t limited to basic exports or forced to rebuild context from scratch. The data remains intact, connected, and usable.

Ownership supports reaching an 8–15x valuation multiple

Control changes how the LMS is perceived during an exit or investment round.

Instead of being a dependency with unknown risks, it becomes infrastructure the buyer can operate, extend, or integrate on their own terms. That reduces diligence friction and removes the assumption that they’ll need to rebuild the platform after acquisition.

And when buyers don’t model a rebuild, the valuation shifts. Training companies dependent on SaaS often sit in the three–five times EBITDA range, while those that own scalable IP routinely land closer to eight–fifteen.

Owning the LMS doesn’t create that uplift on its own, but it removes one of the biggest barriers to achieving it. The platform stops being a constraint and becomes part of the company’s value story.

What Control Looks Like in Practice

Control doesn’t mean starting from scratch. It usually means having a solid foundation built from stable, well-understood components, with the flexibility to add the parts that are specific to your business. The result is a platform that’s easy to evolve without being limited by someone else’s product decisions.

A few characteristics tend to matter most:

Architecture your team can understand and work with

Clear patterns, sensible separation of concerns, and predictable behaviour. Nothing that requires specialist knowledge to maintain.

Infrastructure that can be reproduced anywhere

Infrastructure as Code means your hosting environment isn’t tied to any single party. You can move providers, expand capacity, or hand operations to a buyer’s engineering team without starting over.

Code you’re not locked out of

You get full access to the parts of the platform that are built specifically for your business, along with licensed access to the shared components that make development faster and more reliable. Together, they form a codebase your team can understand, extend, and maintain without depending on a vendor’s closed product. You can build new features, bring work in-house, or work with other partners when you need to. Nothing is hidden, and nothing prevents you from evolving the platform on your own terms.

A roadmap that aligns with your business model

If a new commercial opportunity requires a new type of enrolment, pricing plan, or learning path, you can build it without asking permission.

Control and the Long-Term View

For many companies, control becomes important when something changes. A large client demands new reporting. A compliance shift requires rethinking certification logic. The business launches a second product line. The marketing team needs deeper data access. A partner integration becomes mission-critical.

In each of these cases, the question isn’t “can we do it” but “are we free to do it”.

And this is where SaaS often shows its limits. Not because it’s bad software, but because it can’t bend to the specific demands of your model without trade-offs.

Control removes those trade-offs. It gives you the freedom to respond to new opportunities without negotiating with a vendor or absorbing unpredictable costs.

A Simple Way to Think About It

Control is about deciding which parts of your business you’re willing to outsource to a SaaS and which parts you cannot afford to.

If your LMS drives revenue, customer experience, product innovation, compliance, reporting, or future valuation, giving up control becomes costly over time.

Control brings the opposite effect. It removes uncertainty. It lets the business adapt. And it keeps the technology aligned with the decisions that matter most.

Contact us

Want to own your next learning platform? Start a conversation with us.

Kaine Shutler is the founder and managing director of Plume, a studio specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Dec 9, 2025

Owning Your Learning Platform vs SaaS: Why Control Matters as You Scale

Words by

Kaine Shutler

Key takeaways

High-growth training companies outgrow SaaS because vendor roadmaps, pricing, and data limits restrict their ability to scale, innovate, and respond to new commercial opportunities.

Owning the platform gives the business predictable costs, clean data, and the ability to adapt without waiting for a vendor or absorbing price increases like the average 11.4 percent SaaS rise in 2025.

Control improves both day-to-day operations and long-term optionality by giving the company a platform it can evolve, integrate, and position as an asset rather than a dependency.

When a training company scales, control of your technology becomes an essential strategic requirement. The LMS often sits at the centre of how revenue is created, how customers experience the product, and how the business adapts to change. If you don’t control that system, you don’t fully control the business.

Control isn’t about building everything yourself. It’s about owning the parts of your infrastructure that dictate your future. For most established training providers, the LMS is one of those parts.

The Hidden Cost of Not Being in Control

SaaS (software as a service) learning platforms are attractive early on. They lower the barrier to launch and removes operational overhead. But the trade-off becomes clearer as the business matures. You’re renting a system that shapes your workflows, data practices, pricing exposure, and product roadmap whether you agree with those constraints or not.

Several patterns tend to emerge:

Roadmaps drift away from your needs

Vendors build for their median customer, not for the nuances of your model. When your learner journey needs something specific, you’re often stuck waiting or compromising.

That creates friction internally: sales teams work around missing functionality, operations patch gaps manually, and product teams lower the bar for what “good enough” looks like. Over time, the platform shapes the business instead of the other way around, and the opportunities you can pursue become limited by choices the vendor makes for their broader customer base.

Pricing becomes unpredictable

Per-user models introduce volatility.

At $5 per user per month, 500 learners cost around $30,000 per year. Add a ten-thousand-learner enterprise deal and that figure jumps to $600,000.

Yes, this is expensive. But the bigger issue is that it makes the cost base unpredictable because your largest wins trigger your largest bills.

And that volatility has widened in 2025. SaaS pricing rose by an average of 11.4 percent across the industry, with some vendors increasing fees by more than 300 percent after acquisitions. This is not simply because the recent SaaS investments into AI need to be recouped; the average SaaS price increases 8-12% annually (source), which far outpaces average market inflation rates.

Data sourced from saastr.com

So even if your learner numbers stay the same, your costs will not. Forecasting becomes harder, margins narrow unexpectedly, and long-term contracts become more difficult to price with confidence. Over time, the business becomes cautious about pursuing certain deals because the platform itself behaves like a tax on growth.

Data becomes something you use only in the ways the vendor allows

Most SaaS platforms only let you export basic reports, not the structure that links learners to courses, attempts, and historical context. Without those connections, the data stops being reliable. Simple questions become hard to answer: who struggled and why, where people drop off, which content actually drives outcomes, or which clients need attention. Analytics lose depth, reporting becomes less trustworthy, and teams end up relying on assumptions instead of evidence.

These gaps also make it difficult to automate or personalise the experience because the rules that depend on connected data aren’t available. And when you eventually try to migrate or prepare for due diligence, you’re left with spreadsheets that don’t talk to each other.

Rebuilding the relationships is possible, but the bigger issue is the uncertainty it introduces. You lose visibility into how the business operates, and your ability to adapt is shaped by a platform you don’t control.

Workflows bend to the platform rather than the business

Teams learn the product’s limitations and start adjusting processes to fit. Over time, this erodes operational clarity and slows innovation. What begins as a small workaround becomes the new “normal.” Teams structure onboarding, reporting, and even client delivery around what the platform can or can’t do, rather than what makes sense for the business. These compromises accumulate. They make it harder to introduce new offerings, harder to refine the learner experience, and harder to respond when a major client asks for something slightly different. Eventually the platform stops being a tool that supports the model and becomes the reason certain ideas can’t move forward.

Individually these issues feel manageable. The problem is how they compound. Together they restrict your ability to move decisively.

Control Gives You Strategic Options

Owning your LMS infrastructure doesn’t mean reinventing the wheel. It means you govern the parts that shape your commercial model and customer experience.

With ownership, several shifts happen:

You decide the direction, not a vendor roadmap

When you own the platform, changes follow your priorities rather than someone else’s release cycle.

That matters in markets where your differentiation depends on the learning experience, reporting logic, or how you package and sell content.

You don’t have to wait for a vendor to serve the median customer. If your sales team needs a new enrolment flow or your clients want more granular reporting, you can build it when the business needs it. Control removes the delay that slows or kills momentum.

Your cost base stays predictable

Ownership stabilises costs. Hosting and maintenance scale gradually with usage, but they don’t jump when you add new clients. Moving from one thousand to ten thousand learners increases server load, not licensing fees. You’re no longer exposed to per-user pricing, annual price hikes, or the industry-wide surges seen in 2025.

With a stable cost base, margins are easier to model, long-term contracts become simpler to price, and financial planning isn’t influenced by decisions made outside the company.

Data becomes something you can rely on

When you control the schema, you know how events are captured and stored. You can answer deeper questions about behaviour, segment learners in ways that match your commercial model, and build analytics that support sales, retention, and product decisions.

And if you ever need to move the platform, you take the full data structure with you. You aren’t limited to basic exports or forced to rebuild context from scratch. The data remains intact, connected, and usable.

Ownership supports reaching an 8–15x valuation multiple

Control changes how the LMS is perceived during an exit or investment round.

Instead of being a dependency with unknown risks, it becomes infrastructure the buyer can operate, extend, or integrate on their own terms. That reduces diligence friction and removes the assumption that they’ll need to rebuild the platform after acquisition.

And when buyers don’t model a rebuild, the valuation shifts. Training companies dependent on SaaS often sit in the three–five times EBITDA range, while those that own scalable IP routinely land closer to eight–fifteen.

Owning the LMS doesn’t create that uplift on its own, but it removes one of the biggest barriers to achieving it. The platform stops being a constraint and becomes part of the company’s value story.

What Control Looks Like in Practice

Control doesn’t mean starting from scratch. It usually means having a solid foundation built from stable, well-understood components, with the flexibility to add the parts that are specific to your business. The result is a platform that’s easy to evolve without being limited by someone else’s product decisions.

A few characteristics tend to matter most:

Architecture your team can understand and work with

Clear patterns, sensible separation of concerns, and predictable behaviour. Nothing that requires specialist knowledge to maintain.

Infrastructure that can be reproduced anywhere

Infrastructure as Code means your hosting environment isn’t tied to any single party. You can move providers, expand capacity, or hand operations to a buyer’s engineering team without starting over.

Code you’re not locked out of

You get full access to the parts of the platform that are built specifically for your business, along with licensed access to the shared components that make development faster and more reliable. Together, they form a codebase your team can understand, extend, and maintain without depending on a vendor’s closed product. You can build new features, bring work in-house, or work with other partners when you need to. Nothing is hidden, and nothing prevents you from evolving the platform on your own terms.

A roadmap that aligns with your business model

If a new commercial opportunity requires a new type of enrolment, pricing plan, or learning path, you can build it without asking permission.

Control and the Long-Term View

For many companies, control becomes important when something changes. A large client demands new reporting. A compliance shift requires rethinking certification logic. The business launches a second product line. The marketing team needs deeper data access. A partner integration becomes mission-critical.

In each of these cases, the question isn’t “can we do it” but “are we free to do it”.

And this is where SaaS often shows its limits. Not because it’s bad software, but because it can’t bend to the specific demands of your model without trade-offs.

Control removes those trade-offs. It gives you the freedom to respond to new opportunities without negotiating with a vendor or absorbing unpredictable costs.

A Simple Way to Think About It

Control is about deciding which parts of your business you’re willing to outsource to a SaaS and which parts you cannot afford to.

If your LMS drives revenue, customer experience, product innovation, compliance, reporting, or future valuation, giving up control becomes costly over time.

Control brings the opposite effect. It removes uncertainty. It lets the business adapt. And it keeps the technology aligned with the decisions that matter most.

Contact us

Want to own your next learning platform? Start a conversation with us.

Kaine Shutler is the founder and managing director of Plume, a UK-based agency specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Dec 9, 2025

Owning Your Learning Platform vs SaaS: Why Control Matters as You Scale

Words by

Kaine Shutler

Key takeaways

High-growth training companies outgrow SaaS because vendor roadmaps, pricing, and data limits restrict their ability to scale, innovate, and respond to new commercial opportunities.

Owning the platform gives the business predictable costs, clean data, and the ability to adapt without waiting for a vendor or absorbing price increases like the average 11.4 percent SaaS rise in 2025.

Control improves both day-to-day operations and long-term optionality by giving the company a platform it can evolve, integrate, and position as an asset rather than a dependency.

When a training company scales, control of your technology becomes an essential strategic requirement. The LMS often sits at the centre of how revenue is created, how customers experience the product, and how the business adapts to change. If you don’t control that system, you don’t fully control the business.

Control isn’t about building everything yourself. It’s about owning the parts of your infrastructure that dictate your future. For most established training providers, the LMS is one of those parts.

The Hidden Cost of Not Being in Control

SaaS (software as a service) learning platforms are attractive early on. They lower the barrier to launch and removes operational overhead. But the trade-off becomes clearer as the business matures. You’re renting a system that shapes your workflows, data practices, pricing exposure, and product roadmap whether you agree with those constraints or not.

Several patterns tend to emerge:

Roadmaps drift away from your needs

Vendors build for their median customer, not for the nuances of your model. When your learner journey needs something specific, you’re often stuck waiting or compromising.

That creates friction internally: sales teams work around missing functionality, operations patch gaps manually, and product teams lower the bar for what “good enough” looks like. Over time, the platform shapes the business instead of the other way around, and the opportunities you can pursue become limited by choices the vendor makes for their broader customer base.

Pricing becomes unpredictable

Per-user models introduce volatility.

At $5 per user per month, 500 learners cost around $30,000 per year. Add a ten-thousand-learner enterprise deal and that figure jumps to $600,000.

Yes, this is expensive. But the bigger issue is that it makes the cost base unpredictable because your largest wins trigger your largest bills.

And that volatility has widened in 2025. SaaS pricing rose by an average of 11.4 percent across the industry, with some vendors increasing fees by more than 300 percent after acquisitions. This is not simply because the recent SaaS investments into AI need to be recouped; the average SaaS price increases 8-12% annually (source), which far outpaces average market inflation rates.

Data sourced from saastr.com

So even if your learner numbers stay the same, your costs will not. Forecasting becomes harder, margins narrow unexpectedly, and long-term contracts become more difficult to price with confidence. Over time, the business becomes cautious about pursuing certain deals because the platform itself behaves like a tax on growth.

Data becomes something you use only in the ways the vendor allows

Most SaaS platforms only let you export basic reports, not the structure that links learners to courses, attempts, and historical context. Without those connections, the data stops being reliable. Simple questions become hard to answer: who struggled and why, where people drop off, which content actually drives outcomes, or which clients need attention. Analytics lose depth, reporting becomes less trustworthy, and teams end up relying on assumptions instead of evidence.

These gaps also make it difficult to automate or personalise the experience because the rules that depend on connected data aren’t available. And when you eventually try to migrate or prepare for due diligence, you’re left with spreadsheets that don’t talk to each other.

Rebuilding the relationships is possible, but the bigger issue is the uncertainty it introduces. You lose visibility into how the business operates, and your ability to adapt is shaped by a platform you don’t control.

Workflows bend to the platform rather than the business

Teams learn the product’s limitations and start adjusting processes to fit. Over time, this erodes operational clarity and slows innovation. What begins as a small workaround becomes the new “normal.” Teams structure onboarding, reporting, and even client delivery around what the platform can or can’t do, rather than what makes sense for the business. These compromises accumulate. They make it harder to introduce new offerings, harder to refine the learner experience, and harder to respond when a major client asks for something slightly different. Eventually the platform stops being a tool that supports the model and becomes the reason certain ideas can’t move forward.

Individually these issues feel manageable. The problem is how they compound. Together they restrict your ability to move decisively.

Control Gives You Strategic Options

Owning your LMS infrastructure doesn’t mean reinventing the wheel. It means you govern the parts that shape your commercial model and customer experience.

With ownership, several shifts happen:

You decide the direction, not a vendor roadmap

When you own the platform, changes follow your priorities rather than someone else’s release cycle.

That matters in markets where your differentiation depends on the learning experience, reporting logic, or how you package and sell content.

You don’t have to wait for a vendor to serve the median customer. If your sales team needs a new enrolment flow or your clients want more granular reporting, you can build it when the business needs it. Control removes the delay that slows or kills momentum.

Your cost base stays predictable

Ownership stabilises costs. Hosting and maintenance scale gradually with usage, but they don’t jump when you add new clients. Moving from one thousand to ten thousand learners increases server load, not licensing fees. You’re no longer exposed to per-user pricing, annual price hikes, or the industry-wide surges seen in 2025.

With a stable cost base, margins are easier to model, long-term contracts become simpler to price, and financial planning isn’t influenced by decisions made outside the company.

Data becomes something you can rely on

When you control the schema, you know how events are captured and stored. You can answer deeper questions about behaviour, segment learners in ways that match your commercial model, and build analytics that support sales, retention, and product decisions.

And if you ever need to move the platform, you take the full data structure with you. You aren’t limited to basic exports or forced to rebuild context from scratch. The data remains intact, connected, and usable.

Ownership supports reaching an 8–15x valuation multiple

Control changes how the LMS is perceived during an exit or investment round.

Instead of being a dependency with unknown risks, it becomes infrastructure the buyer can operate, extend, or integrate on their own terms. That reduces diligence friction and removes the assumption that they’ll need to rebuild the platform after acquisition.

And when buyers don’t model a rebuild, the valuation shifts. Training companies dependent on SaaS often sit in the three–five times EBITDA range, while those that own scalable IP routinely land closer to eight–fifteen.

Owning the LMS doesn’t create that uplift on its own, but it removes one of the biggest barriers to achieving it. The platform stops being a constraint and becomes part of the company’s value story.

What Control Looks Like in Practice

Control doesn’t mean starting from scratch. It usually means having a solid foundation built from stable, well-understood components, with the flexibility to add the parts that are specific to your business. The result is a platform that’s easy to evolve without being limited by someone else’s product decisions.

A few characteristics tend to matter most:

Architecture your team can understand and work with

Clear patterns, sensible separation of concerns, and predictable behaviour. Nothing that requires specialist knowledge to maintain.

Infrastructure that can be reproduced anywhere

Infrastructure as Code means your hosting environment isn’t tied to any single party. You can move providers, expand capacity, or hand operations to a buyer’s engineering team without starting over.

Code you’re not locked out of

You get full access to the parts of the platform that are built specifically for your business, along with licensed access to the shared components that make development faster and more reliable. Together, they form a codebase your team can understand, extend, and maintain without depending on a vendor’s closed product. You can build new features, bring work in-house, or work with other partners when you need to. Nothing is hidden, and nothing prevents you from evolving the platform on your own terms.

A roadmap that aligns with your business model

If a new commercial opportunity requires a new type of enrolment, pricing plan, or learning path, you can build it without asking permission.

Control and the Long-Term View

For many companies, control becomes important when something changes. A large client demands new reporting. A compliance shift requires rethinking certification logic. The business launches a second product line. The marketing team needs deeper data access. A partner integration becomes mission-critical.

In each of these cases, the question isn’t “can we do it” but “are we free to do it”.

And this is where SaaS often shows its limits. Not because it’s bad software, but because it can’t bend to the specific demands of your model without trade-offs.

Control removes those trade-offs. It gives you the freedom to respond to new opportunities without negotiating with a vendor or absorbing unpredictable costs.

A Simple Way to Think About It

Control is about deciding which parts of your business you’re willing to outsource to a SaaS and which parts you cannot afford to.

If your LMS drives revenue, customer experience, product innovation, compliance, reporting, or future valuation, giving up control becomes costly over time.

Control brings the opposite effect. It removes uncertainty. It lets the business adapt. And it keeps the technology aligned with the decisions that matter most.

Contact us

Want to own your next learning platform? Start a conversation with us.

Kaine Shutler is the founder and managing director of Plume, a UK-based agency specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.