Dec 9, 2025

Total Cost of Ownership: Seeing the Real Economics of Your Learning Platform

Words by

Kaine Shutler

Key takeaways

SaaS appears cheaper in year one, but per-user pricing and annual increases make it significantly more expensive at scale, with a five-year TCO of roughly $1.6M for 10,000 users versus about $250k for a custom platform.

Custom LMS ownership front-loads investment but stabilises the cost base, allowing margins to expand as learner volume grows rather than shrink under rising subscription fees.

TCO is not just dollars. It includes the operational cost of inflexible workflows, manual workarounds, delayed product changes, and migration barriers that accumulate in SaaS environments.

When a training company grows, the cost of its platform stops being a line item and becomes part of how the business performs. Most teams look at subscription fees or development budgets, but the real cost sits in how the platform behaves over five years: how it scales, how it limits revenue, and how much the business pays simply to keep moving.

Total Cost of Ownership (TCO) makes the gap between SaaS and owned platforms clearer.

SaaS is usually cheaper in year one. It becomes more expensive—and less predictable—the moment you start adding customers.

A custom platform however, requires a larger initial investment, but the cost base stays stable, even as usage grows. For companies with meaningful learner volume or enterprise contracts, that stability often matters more than the first-year price.

The Cost Curve Behind SaaS

SaaS pricing feels simple early on, but the cost curve hides several pressures.

Per-user pricing amplifies cost as you succeed

At $5 per user per month, 500 learners cost around $30,000 per year. A ten-thousand-learner enterprise win takes that to $600,000. Revenue grows, but margins collapse because the platform fee grows in step with the deal.

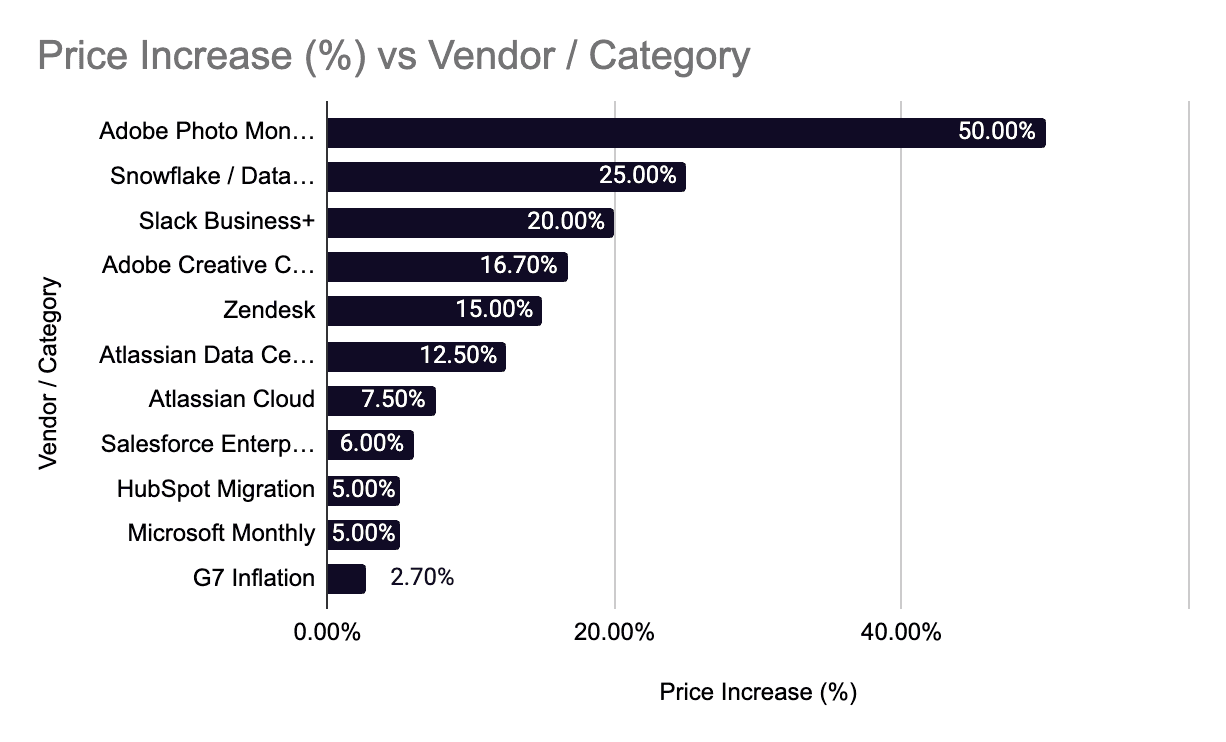

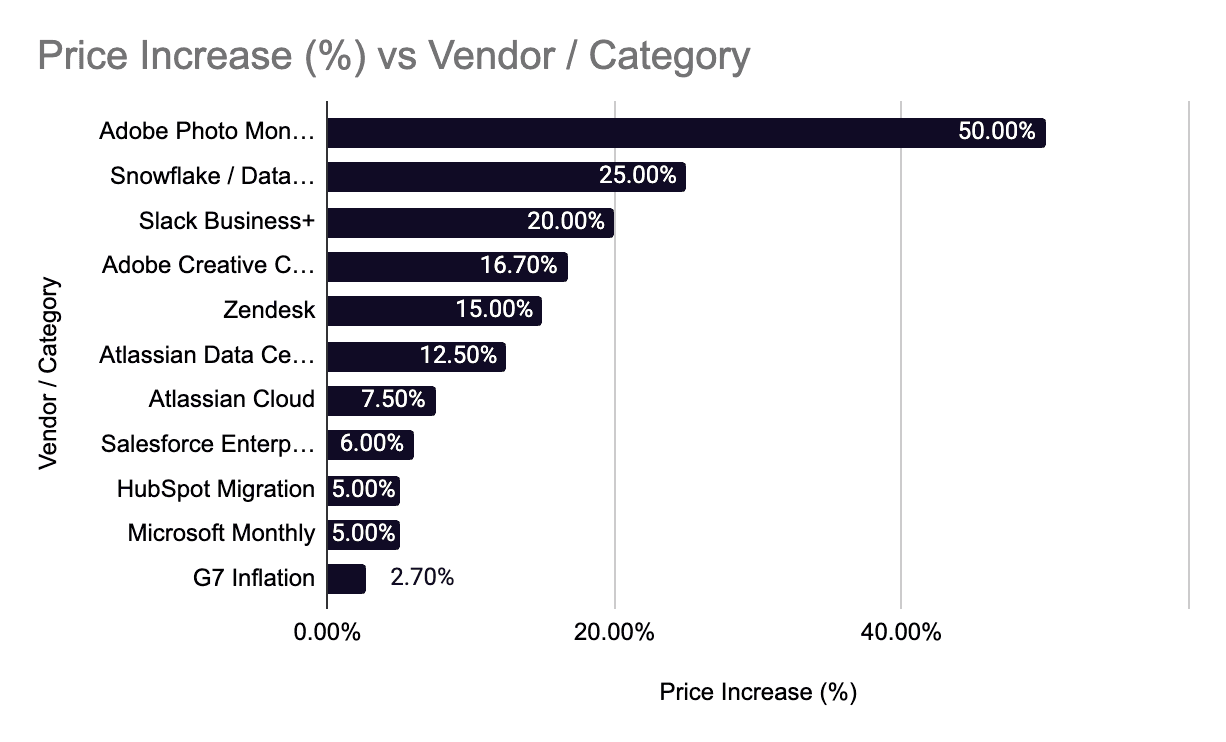

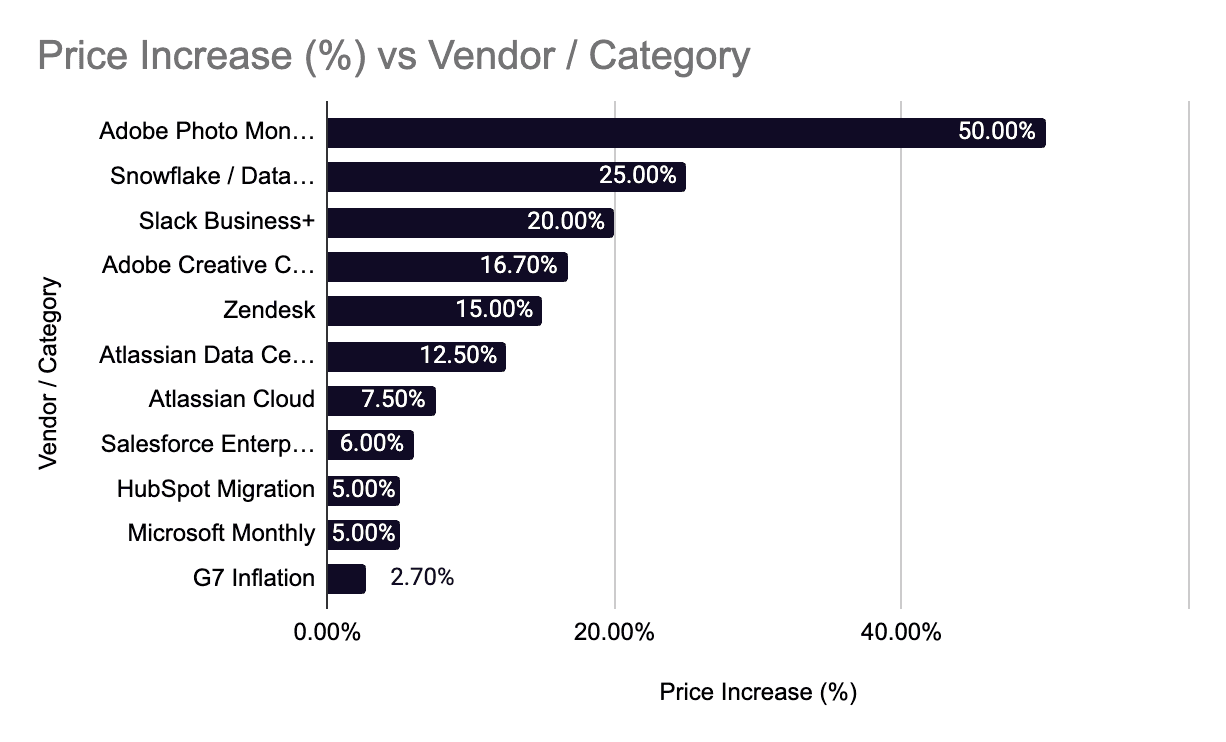

The industry is becoming more expensive

SaaS pricing rose by an average of 11.4 percent in 2025. Some vendors increased fees by more than 300 percent following acquisitions. These changes don’t reflect new value. They reflect an industry trying to shore up profitability. Even if your user count stays flat, your costs will not.

Data sourced from saastr.com

Unpredictable changes make planning harder

Per-user and tiered models force you to guess what your platform will cost next year. One client signing a larger contract or one vendor changing its billing rules can reshape your margin. Long-term agreements become harder to price, and forecasting loses precision.

Hidden fees accumulate

API overages, storage surcharges, paid add-ons, and forced upgrades rarely appear in the initial conversation. They show up later when you’re fully embedded.

None of this makes SaaS “bad.” It just means the economics reward early-stage teams and then sting established providers.

The Custom Cost Curve

A custom platform behaves differently. The upfront investment is higher—often around $150,000 depending on scope—but the cost stabilises afterwards.

Marginal cost approaches zero

Scaling from one thousand to ten thousand learners increases server load, not licensing fees. Hosting might grow from a few thousand dollars per year to six or seven thousand, but it doesn’t multiply with usage.

Maintenance stays flat

A standard maintenance agreement sits around $20,000 per year and doesn’t fluctuate with learner volume. That predictability matters when you’re planning multi-year contracts or budgeting for growth.

You avoid the “success tax”

Adding a major client doesn’t change your cost base. Your LMS becomes a lever for margin expansion rather than a constraint.

The five-year comparison becomes decisive

A typical five-year TCO comparison in your research shows:

SaaS at 10,000 users: ~$1.6M

Custom platform: ~$250k

The crossover point usually appears in year two or three. From that point on, growth becomes financially advantageous rather than punitive.

Cost Isn’t Only Dollar-Based

Direct expenses matter, but they’re not the whole TCO story.

Cost of inflexibility

If your platform can’t support a new pricing model, onboarding flow, or reporting requirement, you either lose the opportunity or stitch together a workaround. Both carry cost—even if it’s not visible on a balance sheet.

Cost of manual operations

When teams compensate for platform limitations, labour expands quietly. Manual enrolment, manual reporting, manual QA of data exports—these activities add up.

Cost of slow change

A vendor’s roadmap rarely matches your priorities. If your next revenue opportunity depends on a feature you can’t control, the delay has a measurable impact.

Cost of migration

If the platform stops serving you, switching becomes a multi-month effort. With SaaS, the migration cost is borne by you, not the vendor.

TCO brings these indirect costs into view because they affect how efficiently the business converts investment into revenue.

Why Predictability Matters More at Scale

For established providers, TCO isn’t about saving money in the abstract. It’s about creating a cost base that:

stays stable as learner volume grows

allows accurate forecasting of profit and cash flow

avoids the surprises that affect board confidence

protects margins during enterprise contract negotiation

avoids dependency on vendor pricing strategies

When your platform behaves predictably, financial planning becomes simpler and growth doesn’t trigger a larger bill.

The Connection to Valuation

This isn’t an exit article (that’s here), but cost profiles do influence valuation. Buyers discount businesses with cost structures that expand unpredictably or depend on external pricing. A custom platform doesn’t guarantee a higher multiple, but it removes one of the major reasons companies stay in the three–five times EBITDA range. When the cost base is controlled, transferable, and stable, the platform becomes part of the value rather than a risk the buyer has to model.

A Practical Way Forward

If you’re evaluating TCO, the goal isn’t to choose the cheapest path. It’s to choose the path that aligns with how your business grows.

A pragmatic approach looks like this:

Understand your projected learner volume over the next three to five years

Model your SaaS costs at low, medium, and high-growth scenarios

Identify the operational constraints that currently create hidden cost

Map the investment required for a custom platform

Compare not just year one, but cumulative cost and margin impact

When you look beyond the first year, the economic picture becomes clearer. The companies that outgrow SaaS aren’t doing it because they want more control in the abstract. They’re doing it because the economics reward ownership once scale is real.

Contact us

If you’re planning for growth and want a clearer picture of your long-term LMS costs, let’s explore what your next five years could look like. Contact us.

Kaine Shutler is the founder and managing director of Plume, a studio specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Dec 9, 2025

Total Cost of Ownership: Seeing the Real Economics of Your Learning Platform

Words by

Kaine Shutler

Key takeaways

SaaS appears cheaper in year one, but per-user pricing and annual increases make it significantly more expensive at scale, with a five-year TCO of roughly $1.6M for 10,000 users versus about $250k for a custom platform.

Custom LMS ownership front-loads investment but stabilises the cost base, allowing margins to expand as learner volume grows rather than shrink under rising subscription fees.

TCO is not just dollars. It includes the operational cost of inflexible workflows, manual workarounds, delayed product changes, and migration barriers that accumulate in SaaS environments.

When a training company grows, the cost of its platform stops being a line item and becomes part of how the business performs. Most teams look at subscription fees or development budgets, but the real cost sits in how the platform behaves over five years: how it scales, how it limits revenue, and how much the business pays simply to keep moving.

Total Cost of Ownership (TCO) makes the gap between SaaS and owned platforms clearer.

SaaS is usually cheaper in year one. It becomes more expensive—and less predictable—the moment you start adding customers.

A custom platform however, requires a larger initial investment, but the cost base stays stable, even as usage grows. For companies with meaningful learner volume or enterprise contracts, that stability often matters more than the first-year price.

The Cost Curve Behind SaaS

SaaS pricing feels simple early on, but the cost curve hides several pressures.

Per-user pricing amplifies cost as you succeed

At $5 per user per month, 500 learners cost around $30,000 per year. A ten-thousand-learner enterprise win takes that to $600,000. Revenue grows, but margins collapse because the platform fee grows in step with the deal.

The industry is becoming more expensive

SaaS pricing rose by an average of 11.4 percent in 2025. Some vendors increased fees by more than 300 percent following acquisitions. These changes don’t reflect new value. They reflect an industry trying to shore up profitability. Even if your user count stays flat, your costs will not.

Data sourced from saastr.com

Unpredictable changes make planning harder

Per-user and tiered models force you to guess what your platform will cost next year. One client signing a larger contract or one vendor changing its billing rules can reshape your margin. Long-term agreements become harder to price, and forecasting loses precision.

Hidden fees accumulate

API overages, storage surcharges, paid add-ons, and forced upgrades rarely appear in the initial conversation. They show up later when you’re fully embedded.

None of this makes SaaS “bad.” It just means the economics reward early-stage teams and then sting established providers.

The Custom Cost Curve

A custom platform behaves differently. The upfront investment is higher—often around $150,000 depending on scope—but the cost stabilises afterwards.

Marginal cost approaches zero

Scaling from one thousand to ten thousand learners increases server load, not licensing fees. Hosting might grow from a few thousand dollars per year to six or seven thousand, but it doesn’t multiply with usage.

Maintenance stays flat

A standard maintenance agreement sits around $20,000 per year and doesn’t fluctuate with learner volume. That predictability matters when you’re planning multi-year contracts or budgeting for growth.

You avoid the “success tax”

Adding a major client doesn’t change your cost base. Your LMS becomes a lever for margin expansion rather than a constraint.

The five-year comparison becomes decisive

A typical five-year TCO comparison in your research shows:

SaaS at 10,000 users: ~$1.6M

Custom platform: ~$250k

The crossover point usually appears in year two or three. From that point on, growth becomes financially advantageous rather than punitive.

Cost Isn’t Only Dollar-Based

Direct expenses matter, but they’re not the whole TCO story.

Cost of inflexibility

If your platform can’t support a new pricing model, onboarding flow, or reporting requirement, you either lose the opportunity or stitch together a workaround. Both carry cost—even if it’s not visible on a balance sheet.

Cost of manual operations

When teams compensate for platform limitations, labour expands quietly. Manual enrolment, manual reporting, manual QA of data exports—these activities add up.

Cost of slow change

A vendor’s roadmap rarely matches your priorities. If your next revenue opportunity depends on a feature you can’t control, the delay has a measurable impact.

Cost of migration

If the platform stops serving you, switching becomes a multi-month effort. With SaaS, the migration cost is borne by you, not the vendor.

TCO brings these indirect costs into view because they affect how efficiently the business converts investment into revenue.

Why Predictability Matters More at Scale

For established providers, TCO isn’t about saving money in the abstract. It’s about creating a cost base that:

stays stable as learner volume grows

allows accurate forecasting of profit and cash flow

avoids the surprises that affect board confidence

protects margins during enterprise contract negotiation

avoids dependency on vendor pricing strategies

When your platform behaves predictably, financial planning becomes simpler and growth doesn’t trigger a larger bill.

The Connection to Valuation

This isn’t an exit article (that’s here), but cost profiles do influence valuation. Buyers discount businesses with cost structures that expand unpredictably or depend on external pricing. A custom platform doesn’t guarantee a higher multiple, but it removes one of the major reasons companies stay in the three–five times EBITDA range. When the cost base is controlled, transferable, and stable, the platform becomes part of the value rather than a risk the buyer has to model.

A Practical Way Forward

If you’re evaluating TCO, the goal isn’t to choose the cheapest path. It’s to choose the path that aligns with how your business grows.

A pragmatic approach looks like this:

Understand your projected learner volume over the next three to five years

Model your SaaS costs at low, medium, and high-growth scenarios

Identify the operational constraints that currently create hidden cost

Map the investment required for a custom platform

Compare not just year one, but cumulative cost and margin impact

When you look beyond the first year, the economic picture becomes clearer. The companies that outgrow SaaS aren’t doing it because they want more control in the abstract. They’re doing it because the economics reward ownership once scale is real.

Contact us

If you’re planning for growth and want a clearer picture of your long-term LMS costs, let’s explore what your next five years could look like. Contact us.

Kaine Shutler is the founder and managing director of Plume, a UK-based agency specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Dec 9, 2025

Total Cost of Ownership: Seeing the Real Economics of Your Learning Platform

Words by

Kaine Shutler

Key takeaways

SaaS appears cheaper in year one, but per-user pricing and annual increases make it significantly more expensive at scale, with a five-year TCO of roughly $1.6M for 10,000 users versus about $250k for a custom platform.

Custom LMS ownership front-loads investment but stabilises the cost base, allowing margins to expand as learner volume grows rather than shrink under rising subscription fees.

TCO is not just dollars. It includes the operational cost of inflexible workflows, manual workarounds, delayed product changes, and migration barriers that accumulate in SaaS environments.

When a training company grows, the cost of its platform stops being a line item and becomes part of how the business performs. Most teams look at subscription fees or development budgets, but the real cost sits in how the platform behaves over five years: how it scales, how it limits revenue, and how much the business pays simply to keep moving.

Total Cost of Ownership (TCO) makes the gap between SaaS and owned platforms clearer.

SaaS is usually cheaper in year one. It becomes more expensive—and less predictable—the moment you start adding customers.

A custom platform however, requires a larger initial investment, but the cost base stays stable, even as usage grows. For companies with meaningful learner volume or enterprise contracts, that stability often matters more than the first-year price.

The Cost Curve Behind SaaS

SaaS pricing feels simple early on, but the cost curve hides several pressures.

Per-user pricing amplifies cost as you succeed

At $5 per user per month, 500 learners cost around $30,000 per year. A ten-thousand-learner enterprise win takes that to $600,000. Revenue grows, but margins collapse because the platform fee grows in step with the deal.

The industry is becoming more expensive

SaaS pricing rose by an average of 11.4 percent in 2025. Some vendors increased fees by more than 300 percent following acquisitions. These changes don’t reflect new value. They reflect an industry trying to shore up profitability. Even if your user count stays flat, your costs will not.

Data sourced from saastr.com

Unpredictable changes make planning harder

Per-user and tiered models force you to guess what your platform will cost next year. One client signing a larger contract or one vendor changing its billing rules can reshape your margin. Long-term agreements become harder to price, and forecasting loses precision.

Hidden fees accumulate

API overages, storage surcharges, paid add-ons, and forced upgrades rarely appear in the initial conversation. They show up later when you’re fully embedded.

None of this makes SaaS “bad.” It just means the economics reward early-stage teams and then sting established providers.

The Custom Cost Curve

A custom platform behaves differently. The upfront investment is higher—often around $150,000 depending on scope—but the cost stabilises afterwards.

Marginal cost approaches zero

Scaling from one thousand to ten thousand learners increases server load, not licensing fees. Hosting might grow from a few thousand dollars per year to six or seven thousand, but it doesn’t multiply with usage.

Maintenance stays flat

A standard maintenance agreement sits around $20,000 per year and doesn’t fluctuate with learner volume. That predictability matters when you’re planning multi-year contracts or budgeting for growth.

You avoid the “success tax”

Adding a major client doesn’t change your cost base. Your LMS becomes a lever for margin expansion rather than a constraint.

The five-year comparison becomes decisive

A typical five-year TCO comparison in your research shows:

SaaS at 10,000 users: ~$1.6M

Custom platform: ~$250k

The crossover point usually appears in year two or three. From that point on, growth becomes financially advantageous rather than punitive.

Cost Isn’t Only Dollar-Based

Direct expenses matter, but they’re not the whole TCO story.

Cost of inflexibility

If your platform can’t support a new pricing model, onboarding flow, or reporting requirement, you either lose the opportunity or stitch together a workaround. Both carry cost—even if it’s not visible on a balance sheet.

Cost of manual operations

When teams compensate for platform limitations, labour expands quietly. Manual enrolment, manual reporting, manual QA of data exports—these activities add up.

Cost of slow change

A vendor’s roadmap rarely matches your priorities. If your next revenue opportunity depends on a feature you can’t control, the delay has a measurable impact.

Cost of migration

If the platform stops serving you, switching becomes a multi-month effort. With SaaS, the migration cost is borne by you, not the vendor.

TCO brings these indirect costs into view because they affect how efficiently the business converts investment into revenue.

Why Predictability Matters More at Scale

For established providers, TCO isn’t about saving money in the abstract. It’s about creating a cost base that:

stays stable as learner volume grows

allows accurate forecasting of profit and cash flow

avoids the surprises that affect board confidence

protects margins during enterprise contract negotiation

avoids dependency on vendor pricing strategies

When your platform behaves predictably, financial planning becomes simpler and growth doesn’t trigger a larger bill.

The Connection to Valuation

This isn’t an exit article (that’s here), but cost profiles do influence valuation. Buyers discount businesses with cost structures that expand unpredictably or depend on external pricing. A custom platform doesn’t guarantee a higher multiple, but it removes one of the major reasons companies stay in the three–five times EBITDA range. When the cost base is controlled, transferable, and stable, the platform becomes part of the value rather than a risk the buyer has to model.

A Practical Way Forward

If you’re evaluating TCO, the goal isn’t to choose the cheapest path. It’s to choose the path that aligns with how your business grows.

A pragmatic approach looks like this:

Understand your projected learner volume over the next three to five years

Model your SaaS costs at low, medium, and high-growth scenarios

Identify the operational constraints that currently create hidden cost

Map the investment required for a custom platform

Compare not just year one, but cumulative cost and margin impact

When you look beyond the first year, the economic picture becomes clearer. The companies that outgrow SaaS aren’t doing it because they want more control in the abstract. They’re doing it because the economics reward ownership once scale is real.

Contact us

If you’re planning for growth and want a clearer picture of your long-term LMS costs, let’s explore what your next five years could look like. Contact us.

Kaine Shutler is the founder and managing director of Plume, a UK-based agency specialising in custom learning technology. With 14 years of experience, Kaine has established expertise in Learning Management Systems, UI/UX design, and scalability, working with clients including Google and training businesses across multiple sectors.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.

Plan your next learning platform with our founder

About Plume

As the leading custom LMS provider serving training businesses in the US, UK and Europe, we help businesses design, build and grow pioneering learning tech that unlocks limitless growth potential.